Content

A full-service or full-charge bookkeeper often completes the duties of both a bookkeeper and an accountant. Full-service bookkeeping is often used by small businesses where accounting duties are small enough that a full-time controller is not justified and could be handled by a bookkeeper. But in those same situations, bookkeeping services for small business can be completely outsourced, providing a valuable and useful option to reduce costs and gain critical talent for a growing small business. Outsourced bookkeeping firms often have experienced controllers or CFOs that can help provide additional oversight, often a requirement when a company uses a full-service bookkeeper. While bookkeeping services provide a great start for many small businesses, most also consider fractional or outsourced CFO services to gain a strategic advantage beyond essential bookkeeping services.

- Let’s look into three different options your company could consider to fill this need…

- Most businesses use an electronic method for their bookkeeping, whether it’s a simple spreadsheet or more advanced, specialized software.

- Before you decide who should manage your bookkeeping, determine your needs first and if hiring a service is something you can afford.

- The most important parts of doing your own bookkeeping are staying organized and keeping track of the details.

Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York. You’ll want to create a contract that outlines details, such as deadlines, rates and expectations so that everyone is on the same page.

Bookkeeping services cost: Bottom line

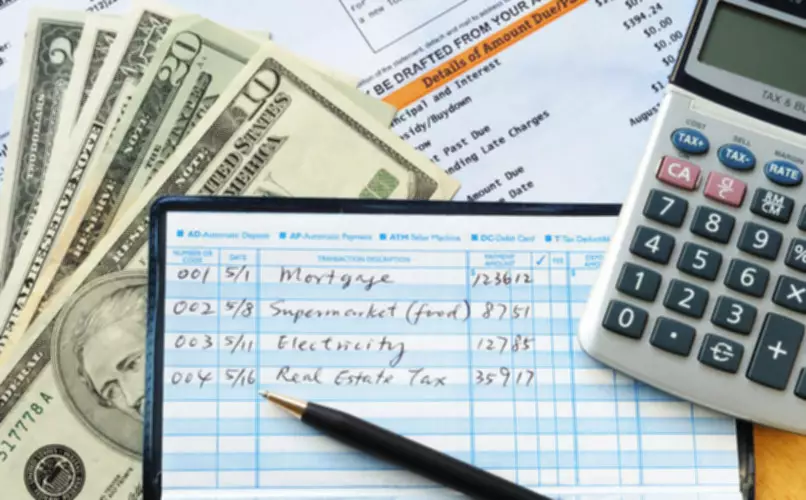

Bookkeeping is the process of recording all financial transactions made by a business. Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts. Not every business has the same bookkeeping needs as others, and their needs will likely change as the company experiences growth. Part-time bookkeepers and outsourced bookkeeping firms are a sound solution for new businesses, while full-time bookkeepers tend to benefit more established companies more.

Many times, switching to an online bookkeeping service is a beneficial move for a company. A full-charge bookkeeper can also manage payroll, handle deposits, create and maintain financial reports, manage the ever-changing world of sales taxes as well as quarterly taxes and withholding. Bookkeepers also reconcile bank statements to internal accounts and even help out during an internal or IRS audit. If you’re ready to take bookkeeping off your plate and delegate this task to someone else, it can be hard to know where to look.

Accounting & Bookkeeping Services

This often involves setting up accounting software and linking it with the client’s bank to pull through transaction data. You might do the bank reconciliation yourself or have your client do it and double-check their work. Plus you’ll check the ledger regularly to make sure everything is flowing through correctly – and fixing it if it isn’t. Bookkeeping focuses on recording and organizing financial data, including tasks such as invoicing, billing, payroll and reconciling transactions.

- You might recommend changes to payment terms to fix cash flow issues, or suggest your client refinance an expensive overdraft.

- However, it’s also pretty standard for a business to be audited when a bank or investor wants to understand its financial position to determine the risk before they invest capital.

- It helps you and your client be transparent with the services your firm offers which will help boost your team-client relationship.

- Very small firms may use a basic spreadsheet, like Microsoft Excel.

- Working a maximum of five hours per month on this particular client’s books, and charging $250 a month, I’m making right around $50 an hour, which is in the ballpark of where I want to be.

- One of the most essential tasks a bookkeeper will do for a small business is making sure they don’t run out of day-to-day money.

- Understanding your options for bookkeeping services and their costs will help you tremendously in ensuring the long-term growth of your company.

The liability accounts on a balance sheet include both current and long-term liabilities. Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans. Accruals will consist of taxes owed including sales tax owed and federal, state, social security, and Medicare tax on the employees which are generally paid quarterly.

Financial vs. Management Reports: What AEC Firms Need to Know

Payments come in electronically, and when they come in, I apply it to the patient’s balance. I’m never in their physical office, so if someone pays in cash, the office has a system to make a cash deposit to their bank and then record it within the system so I know that it was taken care of. Even though I’m giving you the hours it takes me with each of these clients, I don’t necessarily keep track of them.

However, it’s also pretty standard for a business to be audited when a bank or investor wants to understand its financial position to determine the risk before they invest capital. But, with growth comes an increased responsibility for your back office, and your bookkeeper might need help keeping up. A downside of Bench is that it specializes in cash-basis accounting, although there is a custom accrual accounting plan on the Pro plan. Because every client and their needs vary so widely, we provide flexible, unique pricing for every client.

In some cases, this information is needed only at the end of the year for tax preparation. The next couple of articles will deal with the pay of the Accountant. You must mark one of the checkboxes in this section to describe the pay rate of the Accountant.

Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance. There are dozens and dozens of bookkeeping options available and the choices may seem overwhelming. We’ve analyzed and rated the best online bookkeeping services to help bookkeeping services in atlanta you make the best decision when choosing the right one. Start by deciding on the system you want to use, whether it’s an online program, paid software or a spreadsheet. Next, set aside a dedicated time either weekly or biweekly to review your bookkeeping, reconcile transactions and complete necessary data entry.

That way, there are no surprise fees, and clients know what to expect from you. You may also consider throwing in other costs, like a fee for an initial consult, to your pricing structure. There are several options to explore when deciding who should manage your bookkeeping. You can use different programs to get electronic copies of their bills, or they can be emailed to you if there isn’t anything confidential on the bill. The main types of checks I write are reimbursement checks if the teacher buys supplies with her own money, or certain vendors will send invoices, and I will write a check for those. I’m trying to help my client get away from that by training them to use their debit card to pay for vendors rather than having them invoice for a paper check.

Go ahead and identify the services that you want to include and decide what your gold, silver, and bronze services will look like. For many firms, developing a package is the first step on how to start a bookkeeping business. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The dreaded “IRS audit” occurs when a business isn’t filing their taxes correctly.

Overall stats of a small client

When it comes to setting prices for your bookkeeping expertise, take note from Goldilocks and choose a price that’s “just right.” You don’t want your prices to be too low and you don’t want your prices to be too high. Otherwise, you may wind up missing out on profits or scaring off clients with high rates. As you can tell, how much you should charge as a bookkeeper can vary based on a lot of factors. So, you need to take your time when setting prices for your services. So, don’t be afraid to boast about your experience while marketing your accounting firm. And, use it as a competitive advantage when it comes to pricing your offerings.

Esperto di caffè. Appassionato di bacon. Esploratore sottilmente affascinante. Ninja della birra professionista. Creatore. Scrittore dilettante. Introverso.